Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

With a new financial year on the horizon, is it time to rethink how your practice works? BookWell helped RDK reshape its bookkeeping workflows, cutting down repetitive manual work and enabling the team to focus on higher-value advisory services.

They now share a practical guide for building a business case for bookkeeping AI software and tips to help firms embrace receipt and bank statement processing automation. We spoke to Charlotte, founder of RDK, to understand how her company implemented BookWell AI and how accountants can prepare for the future of bookkeeping.

Many accountants worry that automation will reduce billable hours and affect revenue. Charlotte explains that traditional hourly billing often rewards inefficiency, as time spent can matter more than results delivered. This creates tension for bookkeepers who want to work smarter but also fear charging less if tasks are completed quickly.

“I can have a 10-minute chat with a client and add thousands in value. That’s not a fair reflection of the worth I bring,” Charlotte notes.

By shifting to automation, bookkeepers can embrace value-based pricing. With BookWell AI, insights come faster, coding errors are reduced, and clients gain more confidence in their financial records. This approach not only benefits clients but also builds stronger long-term partnerships based on value, not hours.

At RDK, onboarding has been transformed by technology. Rather than drowning in paper receipts, clients are guided through using BookWell’s features—such as ABN and GST alerts, ATO Benchmarking criteria, trial balance checks, and line-by-line transaction categorisation.

“Some of our new clients came in with six months of backlog. Within weeks, they received up-to-date management reports showing what happened in the last month. That simply wouldn’t have been possible without BookWell AI,” Charlotte explains.

This speed and accuracy set the tone for how RDK delivers results. With receipts, invoices, and bank statements processed automatically, the firm shows clients that automation isn’t just a tool—it’s a guarantee of clarity and precision.

Charlotte stresses that adopting bookkeeping AI software requires initial training, both for staff and for clients. But the payoff is huge. Practices that once relied on referrals alone can now expand nationally and even globally, as cloud-based platforms and automation tools open the door to online collaboration.

“Accounting used to be a closed world. Now, with social media, digital onboarding, and AI tools, our reach is no longer limited by geography,” she says.

Like many bookkeepers, Charlotte remembers the stress of managing paper receipts: “I used to worry every night—what if there was a fire, or someone spilled coffee on client records? That risk was always there.”

Now, BookWell AI ensures all receipts and bank statements are securely processed and stored. No more sleepless nights, no wasted hours on manual data entry. This frees time for client calls, compliance checks, or VAT registrations instead of shuffling papers.

Charlotte calls BookWell her “first real hire”—a tool that enabled her to scale RDK, delegate routine tasks, and open the door to more clients and larger projects.

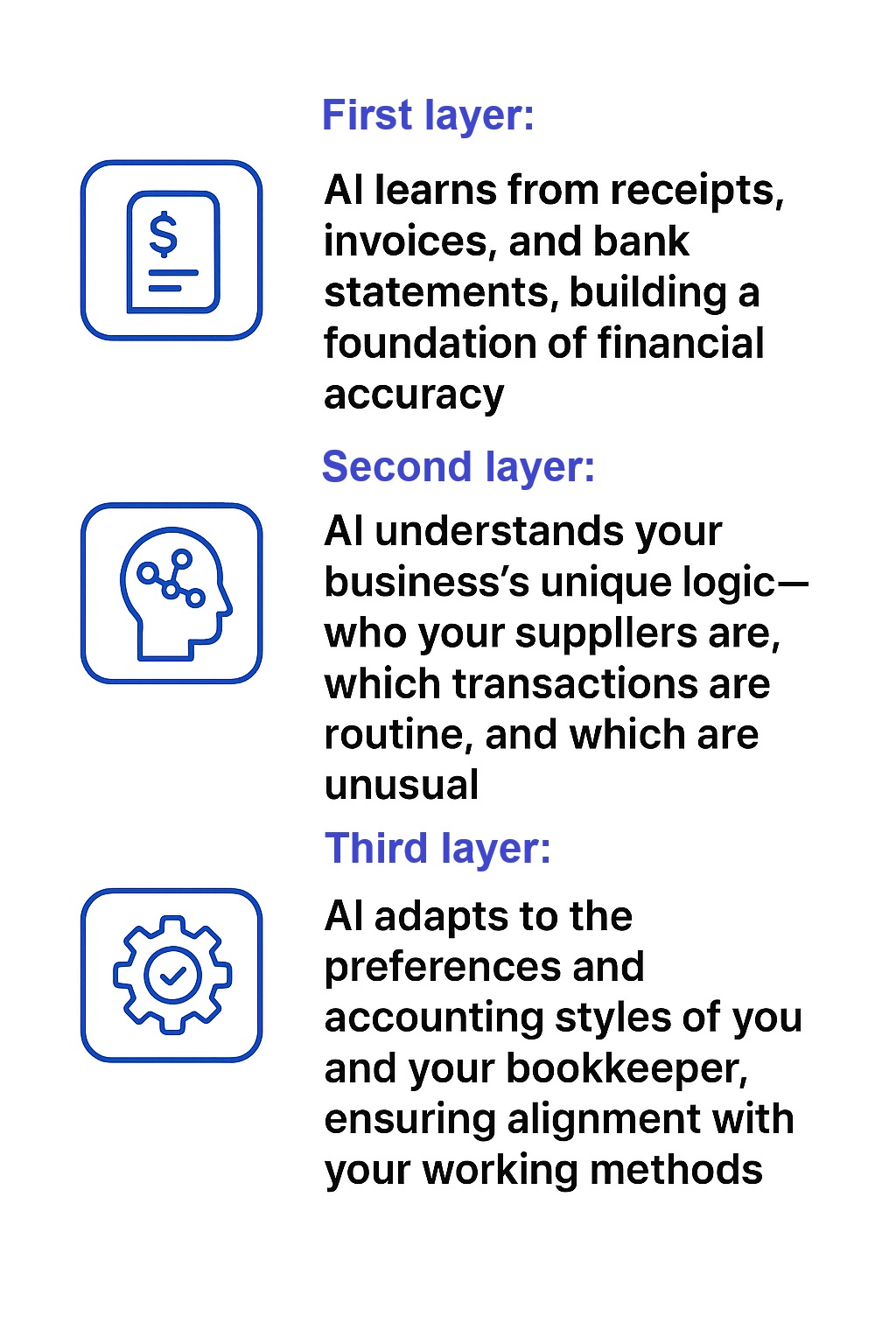

Unlike static software, BookWell is built on a philosophy: “It’s better to understand one company 1000 times than to understand 1000 companies once.”

We pioneered the three-layer learning model that allows AI to evolve:

This constant evolution means the system becomes smarter the longer you use it.

BookWell’s support is hands-on. Charlotte’s team often walks clients through setup, including linking accounts, fetching bills, and categorising tricky transactions. Weekly 15-minute check-ins ensure clients are comfortable, accountable, and up to date with their data.

When a backlog occurs, RDK reverts to the onboarding process to close any gaps. “The key is accountability,” Charlotte explains. “Clients must understand their role in timely data sharing. Once they do, the process is effortless.”

For Charlotte, BookWell was more than software—it was an investment in her firm’s future. Seamless integration with QuickBooks, Xero, and other platforms meant all financial data could be centralised in one place.

With tools like ABN and GST alerts, ATO benchmarking, trial balance checks, and transaction-level categorisation, BookWell offered a complete bookkeeping AI software solution.

Charlotte concludes: “Efficiency isn’t just about saving time—it’s about freeing capacity to focus on what truly matters: growing the business and delivering value to clients. With BookWell, that’s exactly what we’re doing.”

Check out what BookWell can help you and your clients. Start a free trial now!