For decades, accounting firms have been challenged to balance two competing priorities: accuracy and efficiency. Traditional manual bookkeeping methods — endless paperwork, manual data entry, reconciliations, and compliance checks — drain time and resources, leaving little capacity for higher-value advisory services. In today’s rapidly changing digital economy, firms need more than a tool to process data. They need a strategic partner that enhances accuracy, reduces risk, and empowers them to grow sustainably.

This is where BookWell AI steps in. More than just another software platform, BookWell is designed as an intelligent, forward-looking partner for accounting practices. By combining extreme automation, risk foresight, and deeply personalized AI assistance, BookWell liberates firms from repetitive processes, ensures compliance with Australian tax standards, and empowers accountants to focus on what matters most — client strategy, advisory, and business growth.

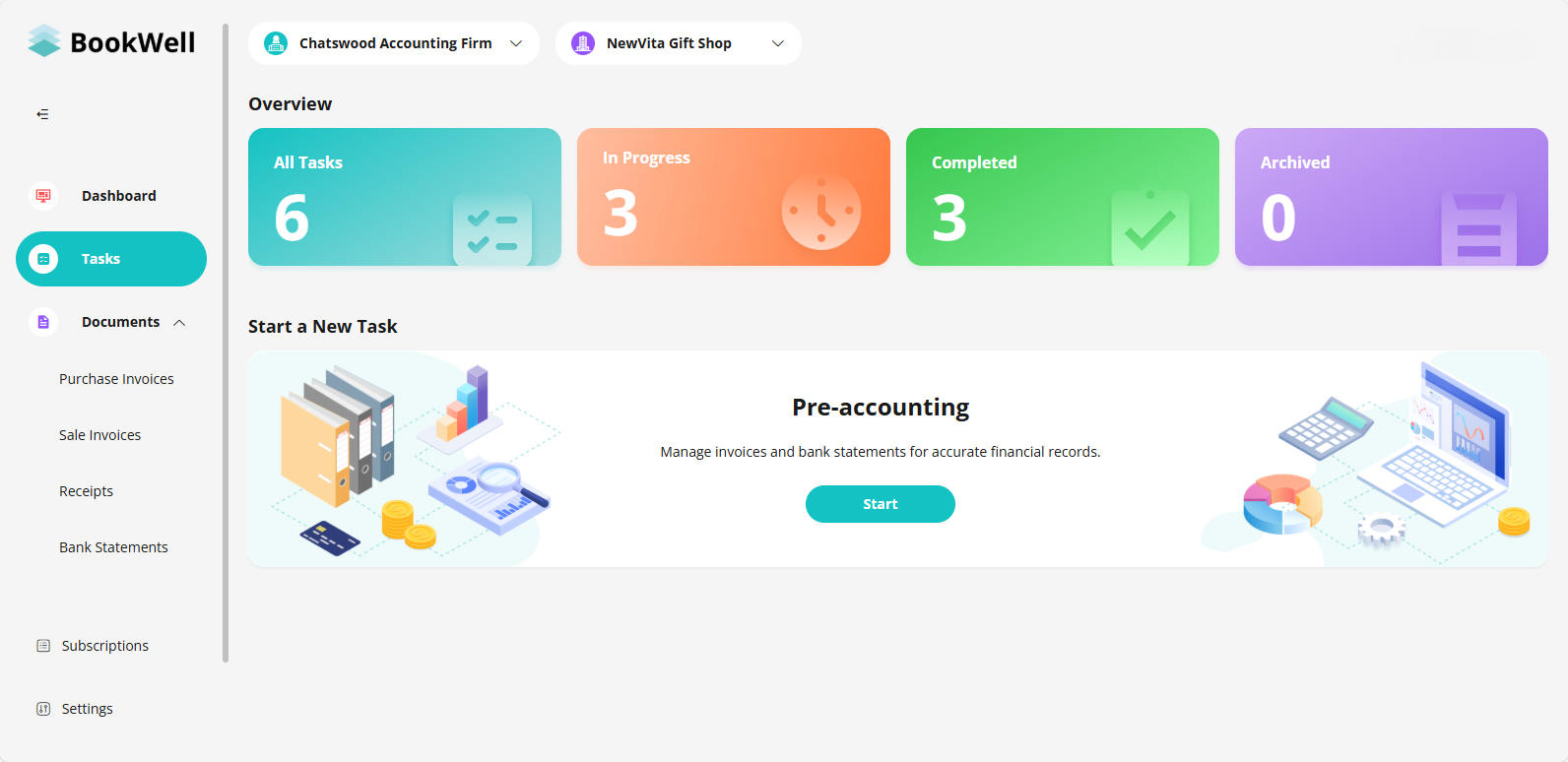

1. Full Automation of Core Workflows: Goodbye Repetition, Hello Efficiency

Every accountant knows that the most time-consuming tasks are often the most repetitive: data entry, invoice processing, and receipt collection. BookWell transforms this pain point into a competitive advantage by automating the end-to-end bookkeeping workflow, from data collection to categorisation and posting.

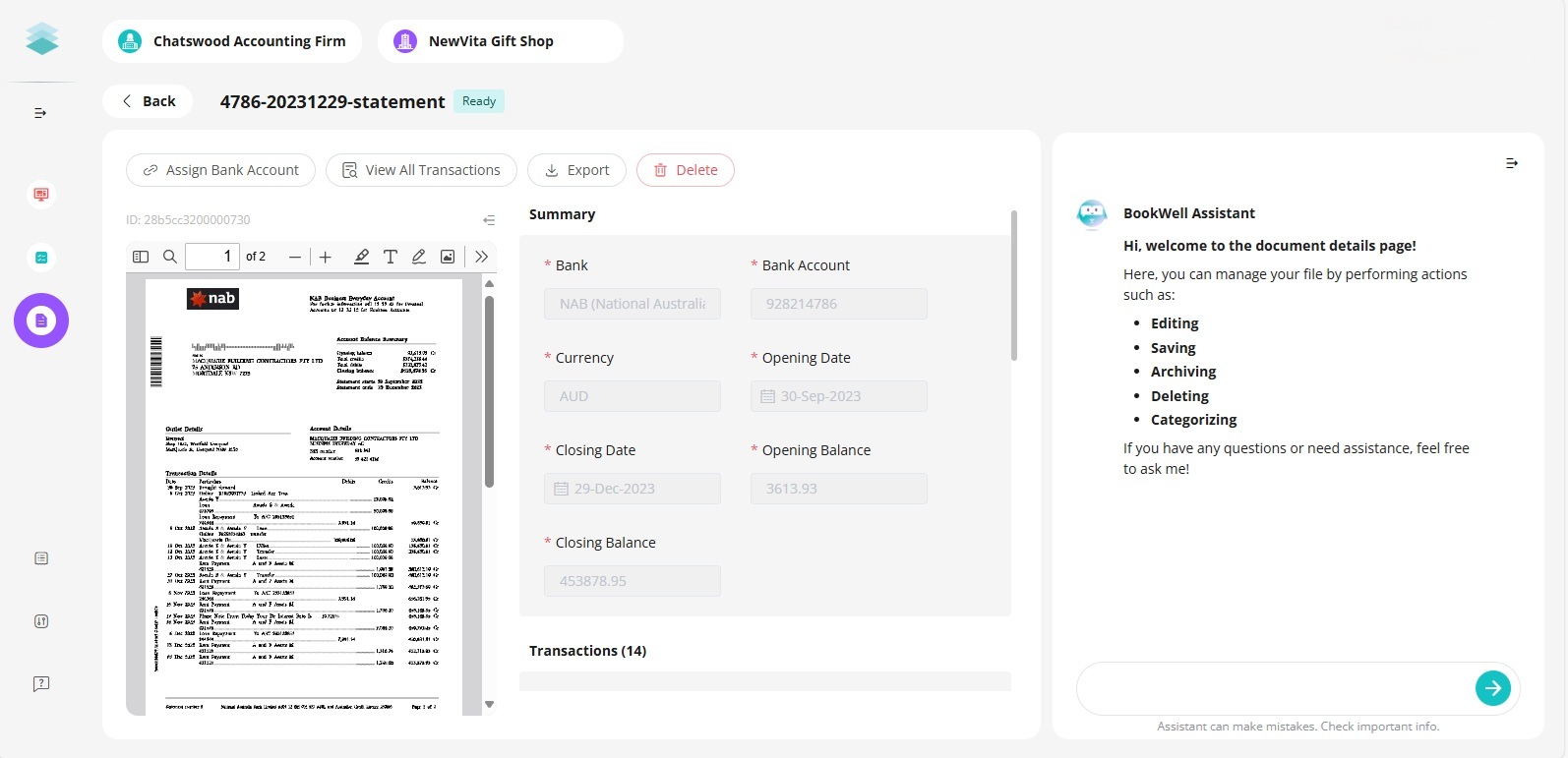

- Smart Document Sorting

No more chasing paper trails or manually organising client submissions. BookWell automatically recognises, classifies, and processes financial documents — whether bank statements, invoices, or receipts — with minimal human intervention.

- High-Precision Data Extraction

BookWell’s document intelligence extracts key financial details such as supplier names, dates, amounts, ABN, and GST data with far greater accuracy than manual entry. This not only improves compliance but also ensures that every financial report starts from a place of trust.

- Line-Item Categorisation

Unlike traditional software, BookWell goes beyond invoice-level recognition. Each individual line item is categorised to the correct ledger account, then aggregated for reporting accuracy. Even complex invoices with multiple tax codes are handled seamlessly, ensuring a perfect trial balance every time.

By automating these processes, BookWell helps firms reclaim valuable hours, reduce human error, and redirect staff capacity towards advisory work and client relationships.

2. Proactive Risk Management: From Reactive Fixes to Strategic Prevention

In an era where compliance failures can mean audits, penalties, and reputational damage, risk management can no longer be an afterthought. BookWell elevates risk oversight from reactive clean-up to proactive prevention, integrating directly with official government data sources.

- ABN Real-Time Verification & Alerts

When invoices are processed, BookWell cross-checks supplier ABNs directly with the ABN Lookup database. If an ABN has expired, been cancelled, or shows irregularities, BookWell immediately flags the transaction. This protects both accountants and their clients from entering into risky or non-compliant dealings.

- ATO Benchmarking Analysis

BookWell intelligently compares client tax data with official ATO industry benchmarks. If a client’s expense ratios or revenue patterns deviate significantly from industry norms, BookWell signals potential audit risks before the ATO does. This foresight allows firms to take corrective actions proactively.

- Automated Audit Trail

Every action performed in BookWell is automatically recorded in a secure, tamper-proof log. This means audit readiness is built into the workflow. Firms can demonstrate transparency, compliance, and diligence without scrambling at year-end or under scrutiny.

With these features, accountants gain not just a compliance tool, but a risk management ally that safeguards business continuity.

3. AI-Powered, Zero-Configuration Workflows: Plug and Play Efficiency

Traditional accounting software often requires extensive configuration: setting up rules, templates, and manual workflows. BookWell eliminates this complexity with AI-native workflows that work straight out of the box.

- No Rules Required

Instead of manually programming categorisation rules, BookWell learns from actual bookkeeping actions. Over time, it adapts to your unique habits, preferences, and workflows — improving accuracy the more you use it.

- File-as-a-Service (FaaS)

Simply upload receipts, invoices, or bank statements in bulk, and BookWell automatically handles recognition, classification, and data extraction. This upload-and-done model eliminates configuration fatigue and gives firms back valuable time.

BookWell doesn’t just automate — it learns, adapts, and evolves with your firm’s unique way of working.

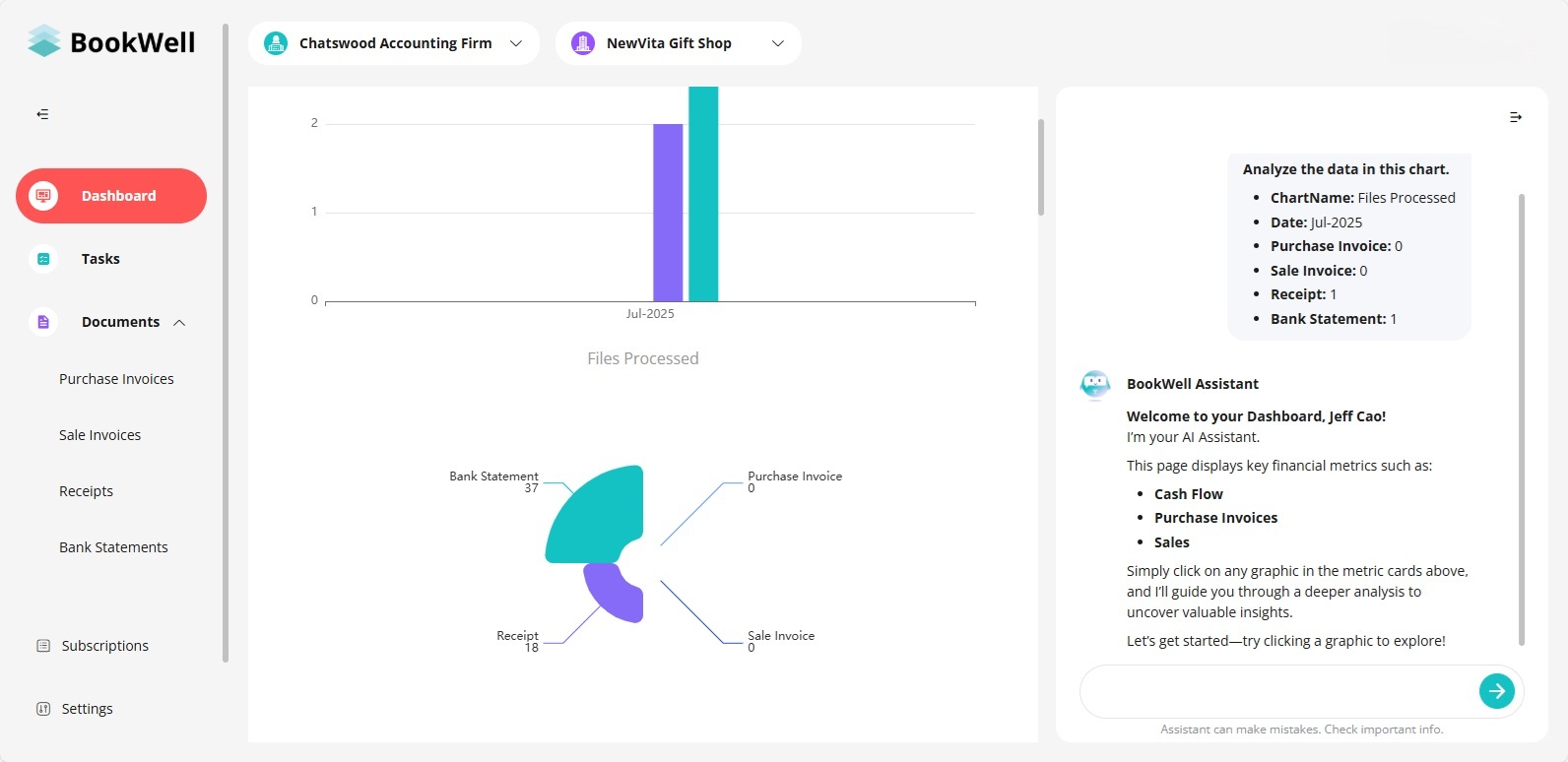

4. Your Dedicated AI Financial Assistant: Deep Insights Made Accessible

At the heart of BookWell is a vision: to give every client and every firm a dedicated, evolving AI assistant that combines advanced technology with financial expertise.

- Smart + Professional

BookWell blends cutting-edge large language model (LLM) technology with a rich financial knowledge base. This ensures that AI-driven recommendations are not only fast, but grounded in professional accounting standards.

- Personalized Adaptation

BookWell learns from your firm’s workflows, your clients’ businesses, and even your team’s preferences. The longer you use it, the more precisely it reflects your accounting style — becoming your indispensable digital partner.

- Interactive Data Analysis

With BookWell’s interactive dashboards, accountants can click on any financial figure and instantly launch an AI-powered analysis. Instead of wrestling with spreadsheets, you can ask questions in plain language and receive insights in seconds. This makes complex financial analysis accessible to everyone on your team.

This is not just automation — it’s intelligence as a service, helping firms transform raw data into actionable strategy.

5. Radical Ease of Use: Zero Training, Maximum Focus

One of the biggest barriers to adopting new software is the learning curve. BookWell’s design philosophy is simple: powerful features should come with intuitive usability.

With a clean, modern interface, BookWell ensures teams can begin using the platform immediately. There’s no need for lengthy training sessions, manuals, or configuration headaches. Staff can focus on serving clients rather than learning software. This ease of use also helps firms onboard new team members quickly, supporting growth without disruption.

6. A Business Model Built for Firms: Cost Control Meets Unlimited Potential

BookWell understands the economics of accounting practices, and its pricing model is designed to eliminate cost anxiety while maximising value.

- Unlimited Document Processing

No matter how many invoices, receipts, or bank statements come in during peak periods, firms never face extra processing fees. This creates predictable expenses and stress-free scalability.

- Unlimited User Seats

Firms can invite unlimited team members without paying extra per user. This encourages seamless collaboration across teams, offices, and client groups.

- Unlimited AI Insights

BookWell doesn’t limit your use of its AI assistant. Firms can run as many analyses, insights, and scenario models as needed to support advisory services — without worrying about hidden costs.

This model ensures that practices of any size, from solo bookkeepers to large firms, can embrace BookWell without fear of spiraling costs.

Why BookWell is the Future of Accounting Partnerships

BookWell is more than a bookkeeping AI software. It is a strategic partner designed for the accounting firms of tomorrow. By automating core workflows, delivering proactive compliance checks, and offering deep AI-driven insights, it empowers accountants to step into the role of trusted advisors, not just data processors.

The future of accounting isn’t about replacing humans with machines. It’s about leveraging AI to magnify human expertise, reduce low-value tasks, and create more room for client strategy and business growth.

With BookWell AI, accountants can:

- Eliminate repetitive manual work.

- Protect clients with proactive compliance alerts.

- Deliver deeper, faster financial insights.

- Scale their practice without scaling their costs.

- Redefine their role as strategic business partners.

The question for firms today is no longer “Should we adopt AI?” — it’s “How fast can we start?”

BookWell is ready to be that partner.

Check out what BookWell can help you and your clients. Start a free trial now!